Proper business foresight and operational efficiency are required for a company to sustain and stay profitable for a longer term. In addition, economic recessions are crucial, which determine management’s ability when major firms fail to generate profits. Going concern concept is one of the basic principles of accounting that states that the accounting statements are formulated so that the company will not be bankrupt or liquidated for the foreseeable future, which generally is for 12 months.

Report Contents

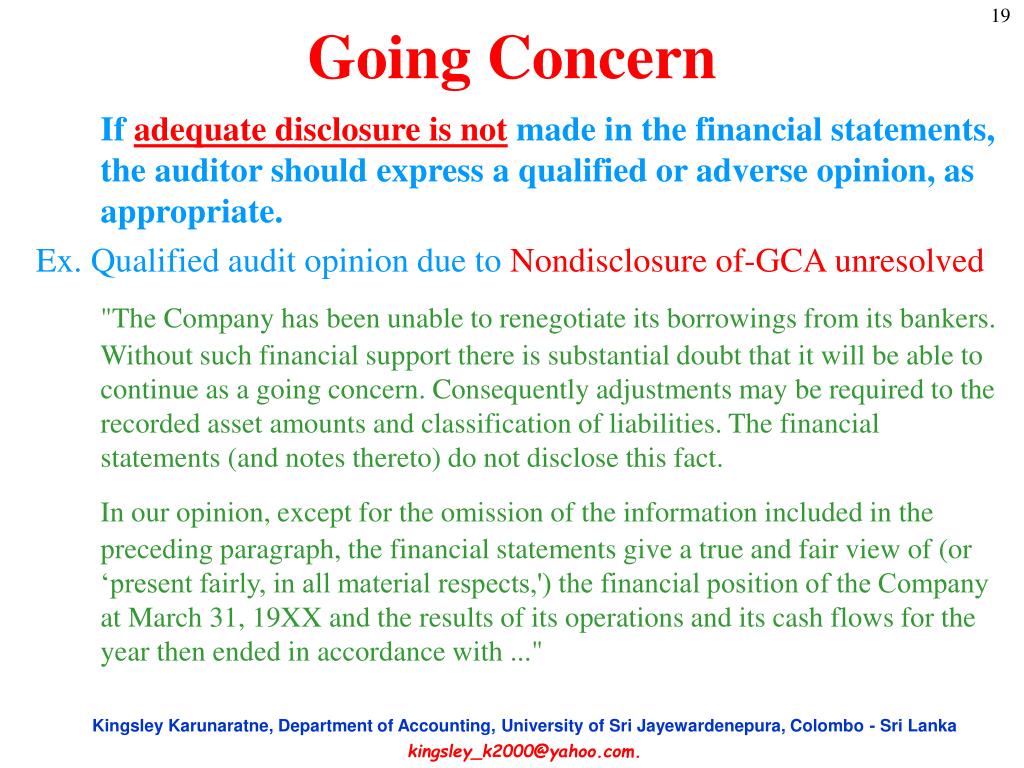

If there’s significant evidence that a privately held business might not be viable under the going concern assumption, the auditor must disclose it in the audit report. Even if the business’s financials aren’t audited, an accountant who has concerns about the business’s viability should disclose those concerns to the business owner. It’s given when the auditor has doubts about the company and the assumption that it is a going concern.

What is your risk tolerance?

Finally, keep in mind that going concern is also relevant to compilation and review engagements. You can specify a date in the support letter that is later than the expected date. If the support comes from an owner-manager, then the written evidence can be a support letter or a written representation. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Going Concern Concept: Definition

The going concern assessment is inherently complex and judgmental and will be under heightened scrutiny for many companies this year due to COVID-19. Management should carefully consider the requirements of IFRS Standards and reevaluate their historical approach to the going concern analysis; it may no longer be sufficient given the current economic environment. For example, the look-forward period for a company with a December 31, 20X0 reporting date is at least the 12 months ended December 31, 20X1, but it may need to be extended depending on the facts and circumstances. For example, if the company expects to lose a major customer in 15 months from the reporting date, it may be necessary to extend the look-forward period up to at least March 31, 20X2. The going concern concept is crucial for calculating how much a company should lessen its expenses or sell its assets. Moreover, it aids the company in delaying a few prepaid payments until future accounting periods.

Going Concern Concept Explained in Video

The calculation of goodwill takes into account the fair value of the net assets acquired less any adjustments for purchase price, encumbrances or unusual conditions that will not affect the future operations. Under this concept, it is assumed that the business will operate for a long period of time. When a business is started, it is assumed definition of form 941 that it will not be dissolved in the near future. An overview discussion of going concern assessments and financial reporting implications. This article discusses the auditor’s responsibilities, as well as the indicators which could highlight where an entity may not be a going concern and the reporting aspects relating to going concern.

Financial Controller: Overview, Qualification, Role, and Responsibilities

- The going concern review can require significant judgement to be applied and the impact of external factors, such as significant global events, can make the assessment of management’s going concern review challenging.

- In the exam it is important to remember that going concern is therefore not just something considered at a particular stage in the audit cycle, but should be an issue that permeates the whole performance and review of an audit.

- Due to this, the federal government provides the company with a bailout package and also a guarantee to clear all its credit payments.

- Going concern is an example of conservatism where entities must take a less aggressive approach to financial reporting.

- Certain red flags may appear on financial statements of publicly traded companies that may indicate a business will not be a going concern in the future.

Accountants use going concern principles to decide what types of reporting should appear on financial statements. Companies that are a going concern may defer reporting long-term assets at current value or liquidating value, but rather at cost. A company remains a going concern when the sale of assets does not impair its ability to continue operation, such as the closure of a small branch office that reassigns the employees to other departments within the company. In times of economic uncertainty, going concern disclosures are more likely to be considered necessary. It is important that disclosures on going concern are clear and robust to meet users’ and regulators’ expectations. The level of detail of disclosures will depend on the company’s specific facts and circumstances, including the nature and extent of impacts on the company.

The court grants the purchase price of liquidating the company upon the petition of one of the firm’s creditors. The National Company has fallen into serious financial problems and cannot cover its duties. Due to this, the federal government provides the company with a bailout package and also a guarantee to clear all its credit payments. A corollary to the going concern concept is the assumption that a business enterprise will not be liquidated within the foreseeable future. For this reason, for purposes of accounting, business enterprises are presumed to carry on their operations indefinitely until such time as they are in fact liquidated. The concept of going concern states that all records are made on the assumption that the business will continue for the foreseeable future.

The auditor should remain alert throughout the audit for conditions or events that raise substantial doubt. So, after the initial review of going concern issues in the planning stage, the auditor considers the impact of new information gained during the subsequent stages of the engagement. One of the most significant contributions that the going concern makes to GAAP is in the area of assets. The entire concept of depreciating and amortizing assets is based on the idea that businesses will continue to operate well into the future. Assets are also reported on the balance sheet at historical costs because of the going concern assumption. If we disregard the going concern and assume the business could be closed within the next year, a liquidation approach to valuing assets would be more appropriate.

The going concern concept is a key assumption under generally accepted accounting principles, or GAAP. It can determine how financial statements are prepared, influence the stock price of a publicly traded company and affect whether a business can be approved for a loan. Suppose an entity knows it will be unable to meet its November 15, 2018, debt balloon payment.

This is because it would make it impossible for the business to carry out its present contractual commitments or to use its resources according to a predetermined plan of operation. However, if it is known that a business will close down in, for example, the next two or three months, it would be more appropriate to state its assets not at cost but at the value at which these can be sold on the closure of the business. Unless it is known that the business will close down at a future time, all transactions are recorded in a routine manner and there is no need for any special valuation or adjustment. © 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work.