The formula to calculate the payback period of an investment depends on whether the periodic cash inflows from the project are even or uneven. The breakeven point is a specific price or value that an investment or project must reach so that the initial cost of that investment or project is completely returned. Whereas the payback period refers to the time it takes to reach the breakeven point. The discounted payback period extends the concept of the payback period by considering the time value of money. Here, future cash inflows are discounted using a particular rate, reflecting their present value. Therefore, the payback period for this project is 5 years, which means that it will take 5 years to recover the initial $100,000 investment from the annual cash inflows of $20,000.

Analysis

But what if the machine for Jimmy’s Jackets will no longer be profitable past 3 years? The payback period is the time it will take for a business to recoup an investment. Consider a company that is deciding on whether happy tax day to buy a new machine. Management will need to know how long it will take to get their money back from the cash flow generated by that asset. The calculation is simple, and payback periods are expressed in years.

Discounted Payback Period

But aside from a strategy, there are other scenarios you can leverage. We explain its formula, how to calculate, example, advantages, disadvantages & differences with ROI. The above article notes that Tesla’s Powerwall is not economically viable for most people. As per the assumptions used in this article, Powerwall’s payback ranged from 17 years to 26 years.

Payback Period: Formula and Calculation Examples

If earnings will continue to increase, a longer payback period might be acceptable. If earnings might decrease after a certain number of years, the investment may not be a good idea even if it breaks even quickly. On the other hand, an investment with a short lifespan could need replacement shortly after its payback period, making it a potentially poor investment. • To calculate the payback period you divide the Initial Investment by Annual Cash Flow.

Discounted Cash Flow

This is because it is always worthwhile to invest in an opportunity in which there is enough net revenue to cover the initial cost. In this article, we will explain the difference between the regular payback period and the discounted payback period. You will also learn the payback period formula and analyze a step-by-step example of calculations. When deciding whether to invest in a project or when comparing projects having different returns, a decision based on payback period is relatively complex. The decision whether to accept or reject a project based on its payback period depends upon the risk appetite of the management.

Decision Rule

- There are a variety of ways to calculate a return on investment (ROI) — net present value, internal rate of return, breakeven — but the simplest is payback period.

- A longer payback time, on the other hand, suggests that the invested capital is going to be tied up for a long period.

- No such adjustment for this is made in the payback period calculation, instead it assumes this is a one-time cost.

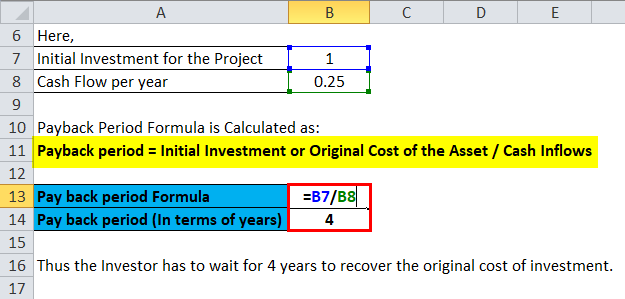

The table is structured the same as the previous example, however, the cash flows are discounted to account for the time value of money. As a general rule of thumb, the shorter the payback period, the more attractive the investment, and the better off the company would be. Assume Company A invests $1 million in a project that is expected to save the company $250,000 each year.

Let’s say the net cash flow amount is expected to be higher, say $240,000 annually. Both the above are financial metrics used for analysis and evaluation of projects and investment opportunities. So, if an investment of $200 has an annual return of $100, the ROI will be 50%, whereas the payback period will be 2 years ($200/$100). As you can see, using this payback period calculator you a percentage as an answer. Multiply this percentage by 365 and you will arrive at the number of days it will take for the project or investment to earn enough cash to pay for itself.

However, there’s a limit to the amount of capital and money available for companies to invest in new projects. Average cash flows represent the money going into and out of the investment. Inflows are any items that go into the investment, such as deposits, dividends, or earnings. Cash outflows include any fees or charges that are subtracted from the balance. Since the second option has a shorter payback period, this may be a better choice for the company. Discounted payback period process is a helpful metric to assess whether or not an investment is worth pursuing.

Unlike other methods of capital budgeting, the payback period ignores the time value of money (TVM). This is the idea that money is worth more today than the same amount in the future because of the earning potential of the present money. Although calculating the payback period is useful in financial and capital budgeting, this metric has applications in other industries. It can be used by homeowners and businesses to calculate the return on energy-efficient technologies such as solar panels and insulation, including maintenance and upgrades. You can use the payback period in your own life when making large purchase decisions and consider their opportunity cost.

It has a wide usage in the investment field to evaluate the viability of putting money in an opportunity after assessing the payback time horizon. This payback period calculator is a tool that lets you estimate the number of years required to break even from an initial investment. You can use it when analyzing different possibilities to invest your money and combine it with other tools, such as the net present value (NPV calculator) or internal rate of return metrics (IRR calculator).